Do you wanna know how to use an Amazon Revenue Calculator? Wanna know if a product is worth your investment and time and calculate its net profit? In the following video, I’m going to show you how to calculate net profit on Amazon and how you can evaluate the profitability of any product, especially on Amazon. I’ll tell you how can you use the Amazon FBA calculator to calculate the net profit and get the product’s profit margin. I’ll also explain to you how the VAT works in the UK and how to include that in your net profit calculation whether you are a VAT-registered or NON-VAT business. And at the end, I’ll also share with you my Excel sheet where I’ve applied all the formulas that will make your life much easier. At the end of this video, you will be able to do product pricing and profit analysis, and Amazon UK VAT calculation using the Amazon revenue calculator.

VAT Calculation in the UK For Amazon Seller

In the UK, unlike the United States, it’s crucial to consider Value Added Tax (VAT) when selling products on Amazon. To illustrate this, we’ll use a product example sourced from the UK market. Suppose you intend to sell a product on Amazon for £15, and you acquire it from UK suppliers at £5 each. How much VAT will you pay for this product in total?

The suppliers in the UK will charge you a 20% VAT on the source price, which amounts to £1. So, in total, you will pay £6 for each unit of this product.

On Amazon, all prices shown to customers include VAT. Amazon collects the 20% VAT from customers on your behalf, and it is your responsibility to report it to HMRC later. If you want to know the price without VAT included, simply divide the Amazon selling price by 120%. For example, if you list the product on Amazon at £15, which includes the 20% VAT (equivalent to £2.5), you will not report the full £2.5 to HMRC, as you have already paid £1 to the supplier as VAT. Therefore, the total amount you need to report to HMRC is £1.5.

This results in the total VAT paid being £1 (to the supplier) plus £1.5, which equals 20% of the selling price of the product.

Using the FBA Revenue Calculator and Calculating Net Profit

To calculate the net profit for a product, you can utilize the FBA (Fulfillment by Amazon) calculator. This tool assists Amazon sellers in evaluating their potential profit margins.

Here are the steps to use the FBA calculator:

- Visit the FBA calculator by opening a new tab.

- Sign in to your Seller Central or continue as a guest.

- If you’re evaluating a wholesale FBA product, click “Search Amazon Catalog.”

- Copy the ASIN (Amazon Standard Identification Number) from the product information section or URL and search for it in the FBA calculator.

Amazon recommends using the new version of the FBA calculator, as it offers additional features not present in the old version. In this new version, there might be a difference in Amazon fees, particularly if you’re not using an Amazon Professional selling plan. If you’re using the professional selling plan, the fee will automatically adjust.

The FBA calculator will display the product information, and you will enter the Amazon selling price. It will also show other fees such as the FBA fee and storage costs, which are incurred if your inventory remains in Amazon’s fulfillment center for an extended period.

Understanding Amazon Storage Fees

Amazon charges storage fees per unit, and this fee increases after three and six months, with a special fee structure for the fourth quarter due to increased workload. Keep in mind that Amazon encourages sellers to keep inventory in its fulfillment centers for shorter durations.

Creating a Net Profit Calculation Excel Sheet

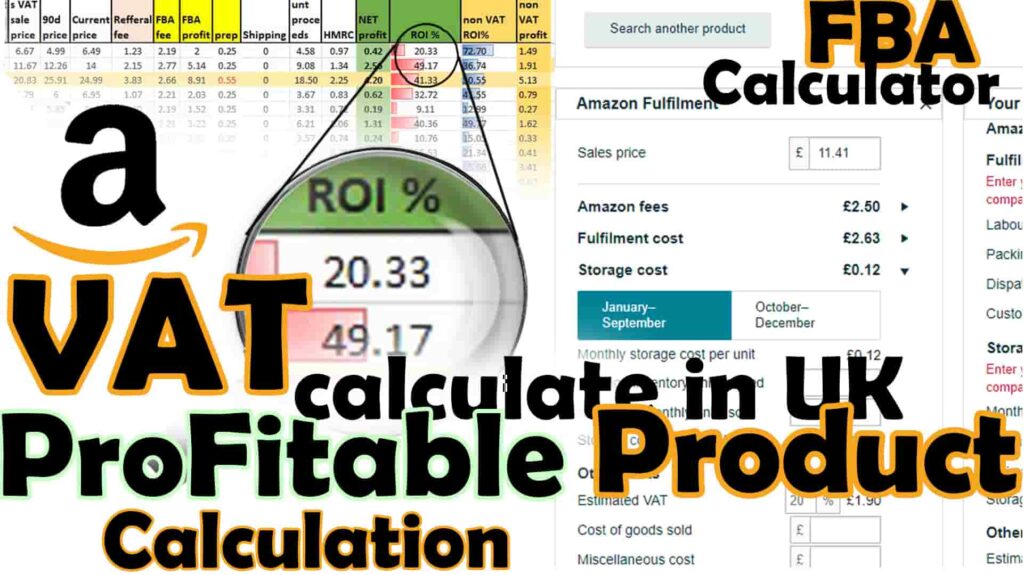

To perform a comprehensive net profit calculation that accounts for various factors such as VAT, Amazon referral fees, and returns, I have provided an Excel sheet with specific calculations. The Excel sheet is divided into three sections: one for 20% VAT registered sellers, another for non-VAT registered sellers, and a final section for tax-exempt sellers.

The sheet is designed for easy input; users only need to enter values in the yellow cells, and all other cells update automatically. It calculates net profit, breakeven points, and profit margins based on the seller’s VAT status.

For non-VAT registered sellers, the Excel sheet simplifies the process of estimating VAT on Amazon fees, making it easy to understand and apply the calculations.

Recording Product Data in the Excel Sheet

The video also provides guidance on how to record product data in an Excel sheet. I have demonstrated how to fill in the necessary information, such as product ASIN, 90-day Best Seller Rank, monthly sales, minimum order quantity, unit price, and other variables. The Excel sheet then automatically calculates net profit, ROI, and other essential metrics based on the data entered.

Conclusion

Mastering Amazon profit calculations is a crucial skill for any seller on the platform. By understanding the VAT system in the UK, utilizing the FBA calculator, and using a well-designed Excel sheet for net profit calculations, you can make informed decisions about your product listings. Always remember to conduct due diligence and analyze all factors before investing in a product.

Additionally, there are subscription-based tools available that can simplify these calculations and provide instant net profit estimates directly on Amazon listing pages, offering convenience and efficiency to sellers.

In the world of e-commerce, informed decisions and accurate calculations can make a significant difference in your success as an Amazon seller.